Provider Take Backs

When an insurance provider withholds payment because of a previous overpayment or incorrect payment, this is called a take back. A provider typically alerts you that they are taking money back by including a PLB segment in the remit file that shows a PLB amount and reason code. At this point you have several options, cut a refund check for the full amount of the take back or deal with a reduced amount on a future remit check from this payer.

How a take back looks on the imported remit

Let’s go over what to look for after you import a remit that contains a take back.

-

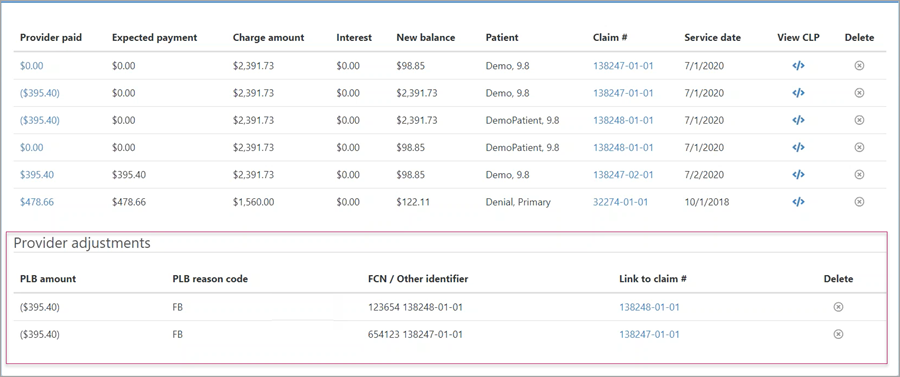

Remits with PLB segments indicate that there is a take back. The PLB segment information displays under the "Provider Adjustment" heading. You will see the PLB amount (amount they are taking back), the reason code such as forward balance (FB), and an identifier. The PLB segment is linked to the claim for which the payment was originally applied.

-

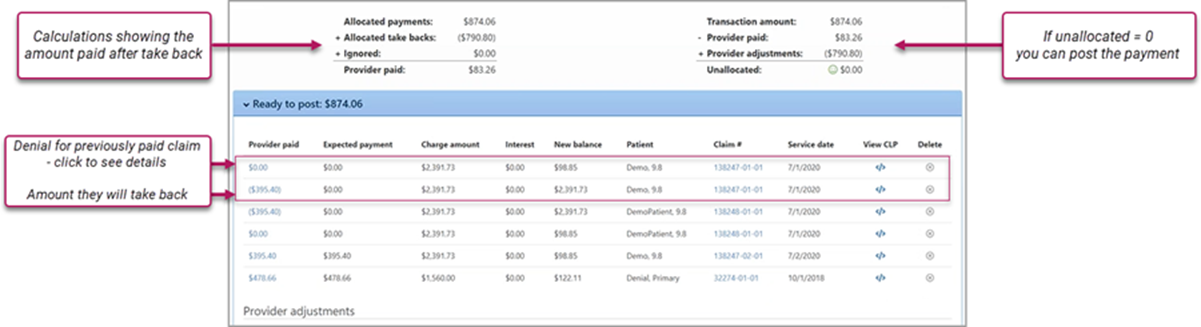

At the top of the page, you will see two calculations. The one on the left shows the allocated payments, the take back amount, and the final provider payment. The right calculation shows the transaction amount, the amount the provider paid, any adjustments, and the unallocated amount. If the unallocated amount equals zero, you can post the payment.

-

Under the ‘Ready to post’ heading, $0.00 indicates a denial on a previously paid claim. The next line shows the amount they are taking back. The last thing to note here is the claim number associated with the take back. You can find that on the same line as the denial and the take back amount.

-

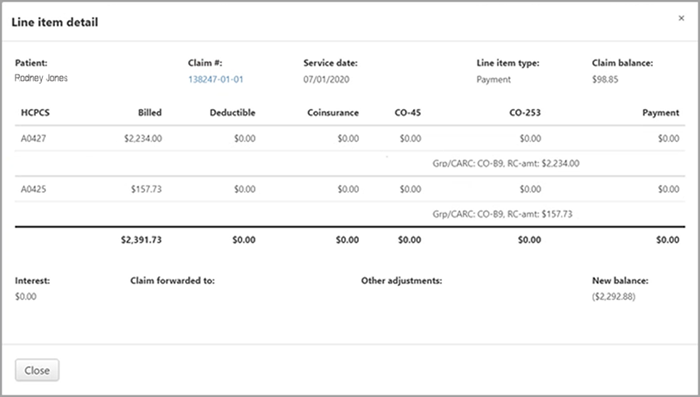

For more information on the denial, click $0.00. Here you can find lots of information including the patient’s name, the claim number, service date, and the denial code. Click Close to return to the transaction page.

-

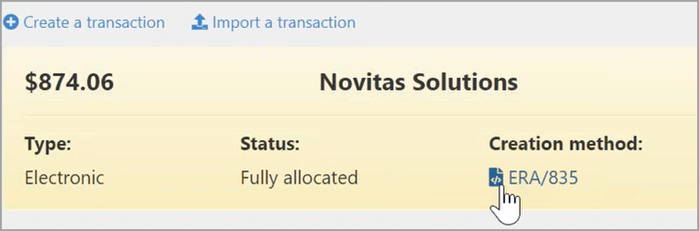

To see the raw data of the imported remit, click the ERA/835 link at the top of the page.

-

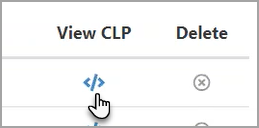

To see the line item in the remit for the entry, click the View CLP link on the same line as the item.

After you post, the status of the claim associated with the take back will be "Follow-up- Take back pending." Click the Credits tab so see the payment and the pending take back. You can also see the denial information, which includes the dial code and denial explanation.

From this point, you can deal with take backs in one of two ways:

- Proactive – resolve with a refund: When you realize an overpayment, cut a refund check and send it to the payer. There are some advantages to cutting a refund check:

- You control the timing of when the money is sent.

- If you do nothing, when the payer takes money back, they will take if from another claim. This can complicate your bookkeeping.

- Reactive: Wait until a future remit from the insurance company arrives. That payment will be reduced by the amount of the overpayment.

Proactive – Resolve with a refund

This action reverses the forwarding balance take back and issues the refund.

- On the Claim page, click the Credits tab.

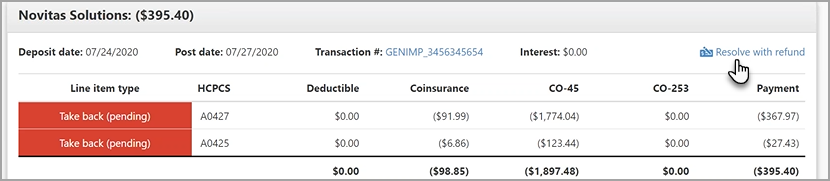

- Go to the block that has the line item type of "Take back (pending)."

-

Click Resolve with a refund.

-

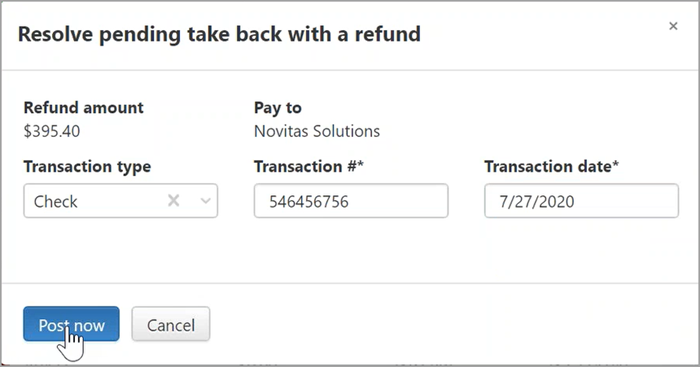

Enter the transaction type, number (such as check number), and date you cut the check.

-

Click Post now.

The claim’s status changes to "Follow-up – Balance after refund."

Under the Credits tab, you will see a "Take back reversal" line item type that indicates that you have reversed the pending take back. This is followed by another block that show the refund amount. You will also see the denial posted.

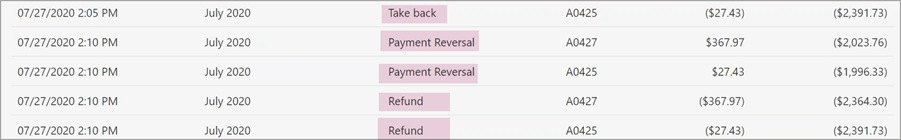

Click the Running Claim Balance tab, to see the payment reversal and the refund.

Reactive

In this scenario, you did not issue a refund check, electing to wait until the next remit from the payer with a reduced amount. When you import the remit that contains the actual take back, you will see the amount the provider paid for the submitted claims. Under the "Provider adjustments" heading, the PLB amount withheld from the payment displays. For example, an allocated payment of $5,000 would be reduced to $3,000 if the PLB amount was $2,000.

After posting the transaction, click the claim link on the same line as the PLB amount. You will see that the take back amount and denial was applied to the claim.