Benefit Plans

A benefit plan details what is covered by the insurance for the group or individual’s health care. A benefit plan is tied to a insurance policy type. For example, a Preferred Provider Organization (PPO) benefit plan could be tied to a policy type of commercial. There can be multiple benefit plans associated with a single policy type.

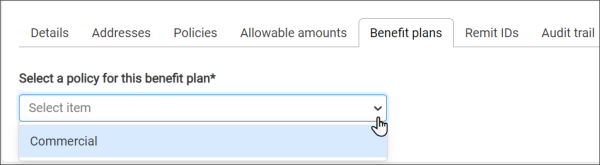

Because the benefit plan is tied to the policy, selecting a policy is the first thing you do after you click Add a benefit plan.

The system displays all the configured policies in the drop-down menu when you click the Select a policy for this benefit plan field. Select a policy and then click Continue to view the "New benefit plan" page.

Benefit Plan Field Definitions

Plan name: Enter the name of the benefit plan.

Policy type: This read-only field contains the policy type you selected on the first window.

Reimbursement rate: The percent this plan will pay to providers according to the plan's reimbursement rates. Medicare reimbursement rates are set by federal legislation and govern how much a provider or supplier receives from Medicare to provide a given medical service or supply.

Payer address: Displays the address on file for the policy you selected. If there are multiple address, click the field and select the address from the list.

Notes: If needed, add a note about the benefit plan.

Allowable Amount

To apply an administered allowable amount to this plan, click the Apply an allowable amount field and then select the allowable amount name from the drop-down menu. After you select the allowable amount, the "Effective date range", "Allowable source", and "Calculation method" fields change to display the ranges administered for that allowable amount.

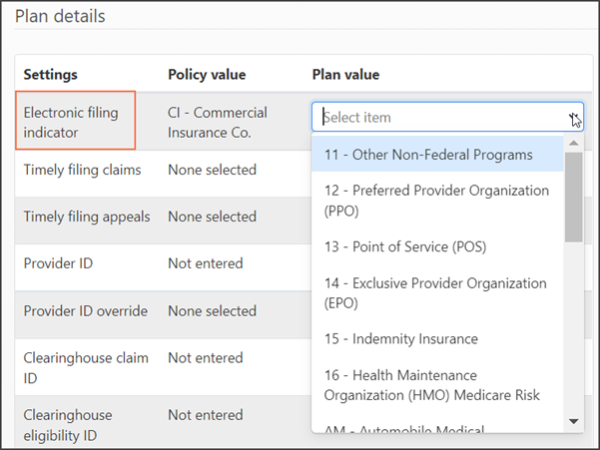

Plan Details

In cases where a value is common across the payer, policy, and plan, ZOLL Billing uses a the following hierarchy;

- Plan values take precedence over the same value type entered for the policy and the payer.

- If the plan does not contain administered values that are common in the policy and the payer, the values entered for the policy takes precedence over the same value type entered for the payer.

Because the system uses the plan value over that of the policy value, the policy values display as part of the Plan Details grid. As you select the value for the plan, remember that the value you enter has priority over that of the policy value.

Electronic filing indicator: An electronic filing indicator is used on ANSI 837 and ANSI 837P (Professional) standard format used to transmit health care claims electronically.

Timely filing claims: Amount of time the insurance company allows for claim submission. If the timely filing is 90 days, you have up to 90 days from the claim's date of service to submit the claim.

Timely filing appeals: The amount of time the insurance company allows for a claim appeal.

Provider ID: Enter you National Provider Identifier (NPI) here. Your NPI is a 10-digit number is required by HIPPA for all healthcare providers in the United States. It is used to identify your company in all HIPPA transactions. If you don't know your NPI, look it up here: https://npiregistry.cms.hhs.gov/. If you don't have an NPI, call 1800-465-3202.

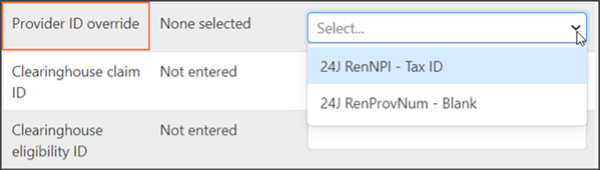

Provider ID override: If you need to override the NPI, ZOLL Billing provides two options.

Clearinghouse fields

A payer ID is a unique five-character code used by the clearinghouse to transmit a claim and eligibility request to the correct payer. It is also used to identify which payer sent a remittance. In order to collect on a claim, send an eligibility request, or forward a remittance, the Payer ID must be 100% correct.

Each clearinghouse has their own Payer ID list and every single payer transaction is assigned an ID. For some payers the Payer ID is the same for a claim, an eligibility check, and a remittance. For others, the claim and remittance identifiers are same but the eligibility identifier is different. Not to confuse things, but you may find cases where the claim, eligibility, and remit identifiers are all unique.

If the identifier is for a specific function such as remits, you will see that information next to the payer name such as Aetna RX (Remits Only) (Z1420).

Examples:

- United Healthcare’s Payer ID is 87726. No unique Payer IDs are listed for remits and eligibility so you would enter the same Payer ID for all three clearinghouse fields (claim, eligibility, and remittance).

- Medicaid of Louisiana's Payer IDs are SB670 for claims, Z1050 for remittance, and SKLA05 for Eligibility.

- Community Care's Payer IDs are 73143 for both claims and remits, and 00448 for Eligibility.

You can find Payer ID lists on the public website of your clearinghouse. For example, if your clearinghouse is ZirMed, you can find the identifiers listed at https://login.zirmed.com/ui/Payers.

To find a payer, click Printer friendly version and use 'control-f' to start the find functionality. You can also click Download (.CSV) to manipulate the data in an Excel spreadsheet.

Each of the clearinghouse fields are mandatory to ZOLL Billing's operation and must contain a value.

- ZirMed claim ID: Enter the claim ID used by this clearinghouse to identify this payer.

- ZirMed remit ID: Enter the remit ID used by this clearinghouse to identify this payer.

- ZirMed eligibility ID: Enter the eligibility ID used to identify this payer.

Primary submission type: Select the submission type you will use for the primary payer.

Secondary submission type: Select the submission type you will use for the secondary payer.

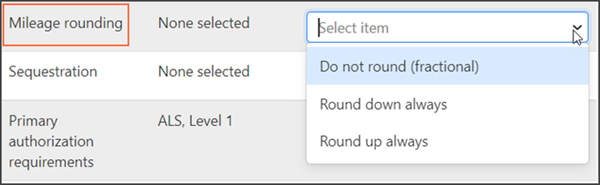

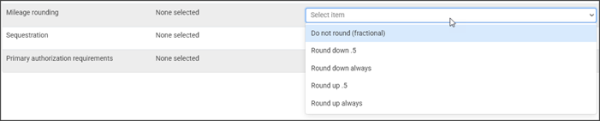

Mileage rounding: Use this field to determine how you apply mileage rounding. You can round up/down, or use fractional mileage.

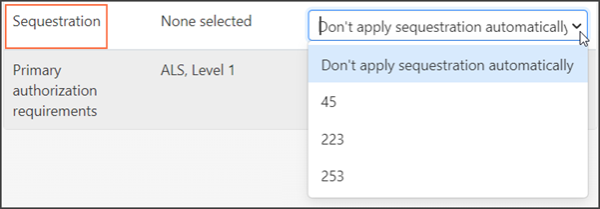

Sequestration: Sequestration is a mandatory 2% payment reduction in the Medicare FFS Program. Select an option from the drop-down menu that matches how your company regulates sequestration.

Requirements Values

Requirements can be made at the payer or plan level. To learn more about each requirement, click here.

Save or Save & Close

To save this plan and add another, click Save.

If you are done entering plans for this policy, click Save & Close.

Edit a Benefit Plan

Click the plan name on the list of configured benefit plans.

Disable/Enable a Benefit Plan

Disable: On the same line as the plan you wish to disable, click the check mark under the Enabled column. The check mark will change into a dash to indicate that the plan is now disabled.

Enable: On the same line as the plan you wish to enable, click the dash under the Enabled column. The dash will change into a check mark to indicate that the plan is now enabled.

Delete a Benefit Plan

On the same line as the benefit plan you wish to delete, click the X under the Delete column.

If you delete a plan that has been applied to an open claim, the system will still process the claim normally but you will not be able to add this plan to new claims.

Mileage - fractional or rounding

To accommodate payer requirements, you can choose to round mileage up, down, or use fractional mileage.

If this is a new insurance, use the information in this section to create the insurance. When you add the policy/plan:

-

Click the Mileage rounding field and then select an entry.

- When you are done configuring the policy/plan, click Save & Close.

To modify an existing policy or plan:

- On the navigation bar, click Payers on the navigation bar.

- Scroll through the list and click the insurance name.

- Click the policies tab.

- Click the Mileage rounding field and then select an entry.

- Click Save & Close.