COVID-19

New ICD-10 codes

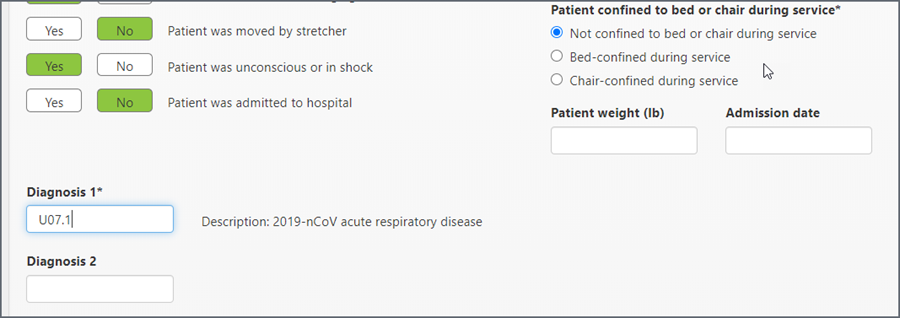

- U07.1: 2019n-CoV acute respiratory disease - Use this code if you are transporting a patient that has tested positive for COVID-19.

- B97.29: Other coronavirus as a cause of diseases classified elsewhere - Use this code if you are unsure if they have COVID.

Enter U07.1 or B97.29 as the primary diagnosis code in the Incident Details tab.

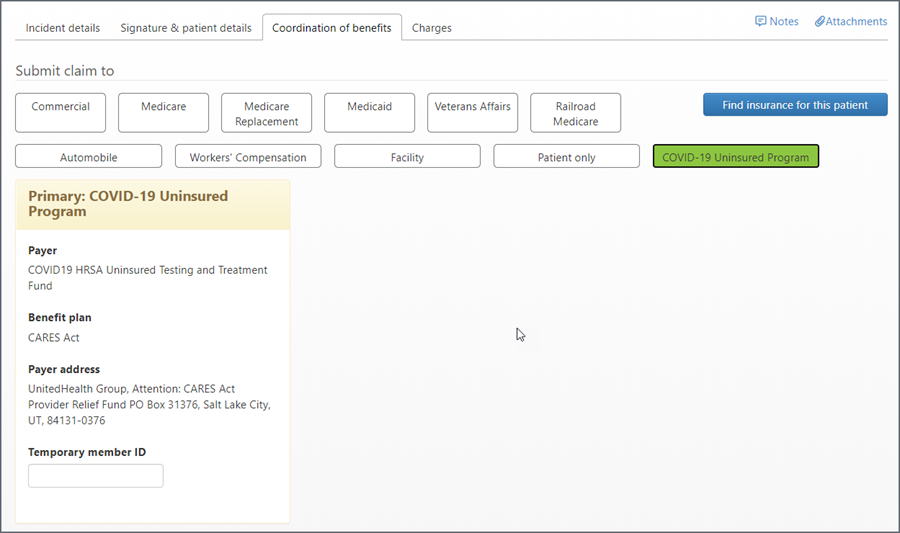

Click Find insurance for this patient. If the patient is uninsured, click the COVID-19 Uninsured Program button on the COB tab. If the patient has insurance, bill as usual.

If you entered U07.1, the primary payer box looks like this:

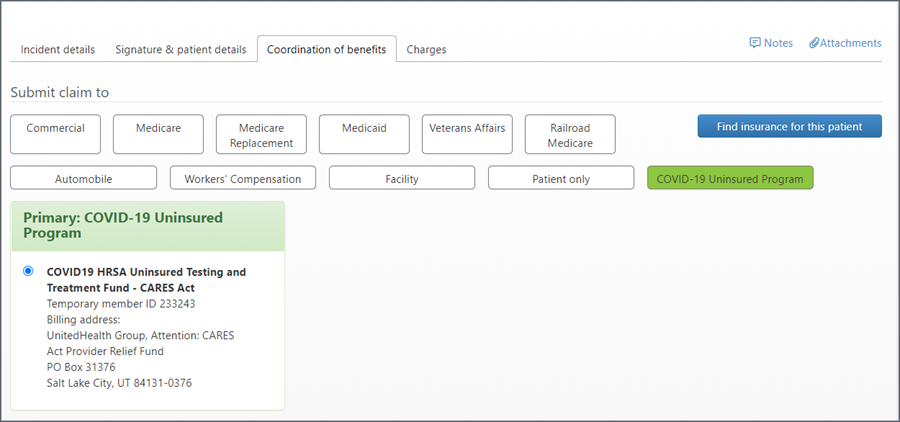

If you entered B97.29, the primary payer box looks like this:

Important notes

- Run Insurance Discovery to see if the patient has insurance. If they do not, then select the COVID button. Once you select the COVID button, you will no longer be able to run Insurance Discovery.

- You must enroll in the Cares Act program to bill for uninsured COVID patients. When you register, they will tell you how to obtain the temporary ID needed to submit the claim.

- The COVID-19 button only displays if you enter one of the two COVID codes listed above as the primary diagnosis on the Incident Details tab.

- They will adjudicate based on the Medicare fee schedule.

- Medicare has suspended sequestration charges from May 1st to December 31st.

- You cannot balance-bill a COVID patient but they are still responsible for their co-pay and deductible.

CS modifier

The Families First Coronavirus Response Act (FFCRA) waives cost-sharing for COVID-19 testing-related services for Medicare Part B patients. Cost-sharing is waived for:

- Office visits that result in the order or administration of the COVID-19 test

- The evaluation of an individual to determine the need for a COVID-19 test

The cost-sharing waiver is in effect for dates of service starting March 18, 2020 until the end of the public health emergency.

Physicians should use the CS modifier on applicable claims to identify the service subject to the cost-sharing waiver. Medicare beneficiaries should not be charged for any coinsurance or deductible for those services. The CS modifier will signal the Medicare Administrative Contractors (MACs) to pay 100% of the allowable cost for the service. Physicians should contact their MACs and request to resubmit applicable claims with dates of service on or after March 18, 2020 that were submitted without the CS modifier. The CS modifier should not be used for services unrelated to COVID-19.

Revenue Adjustments

- On the Claim page, click the Credits tab.

- Click Adjust balance.

- Click the Revenue adjustment button.

- Click the description field. Scroll down the list and click COVID.

- Click Post now.

The status of the claim will change to "Closed - Balance resolved."